Analysis

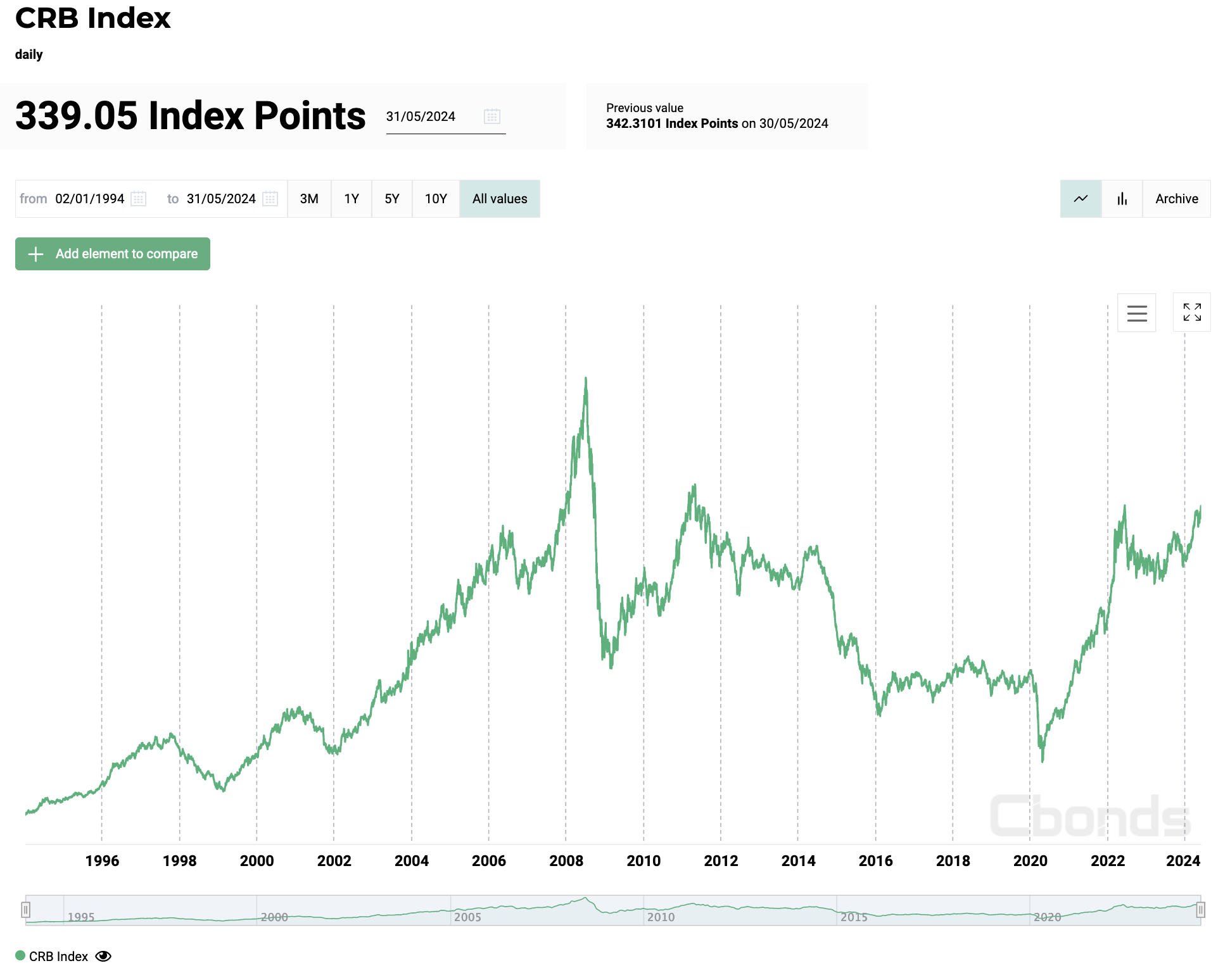

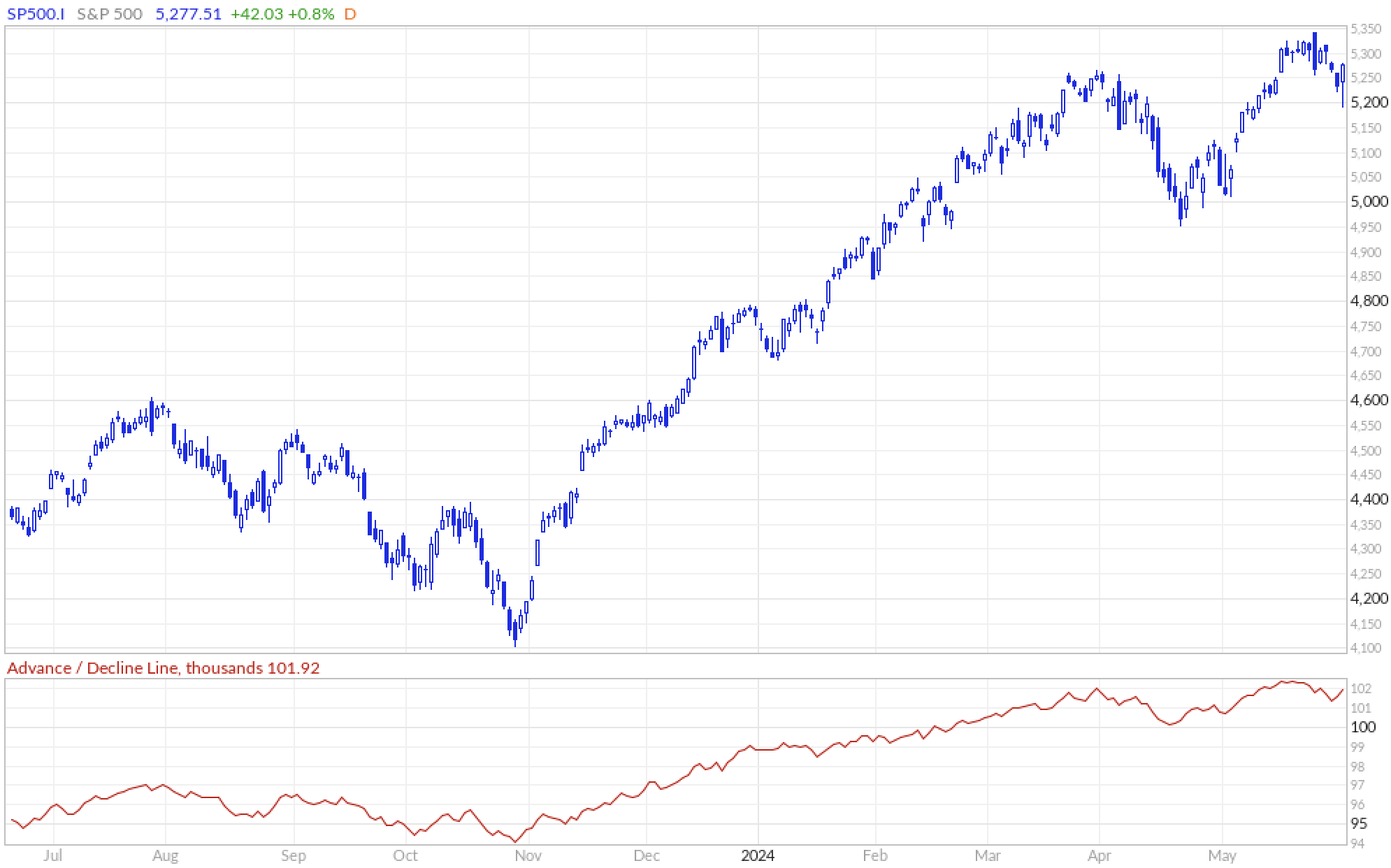

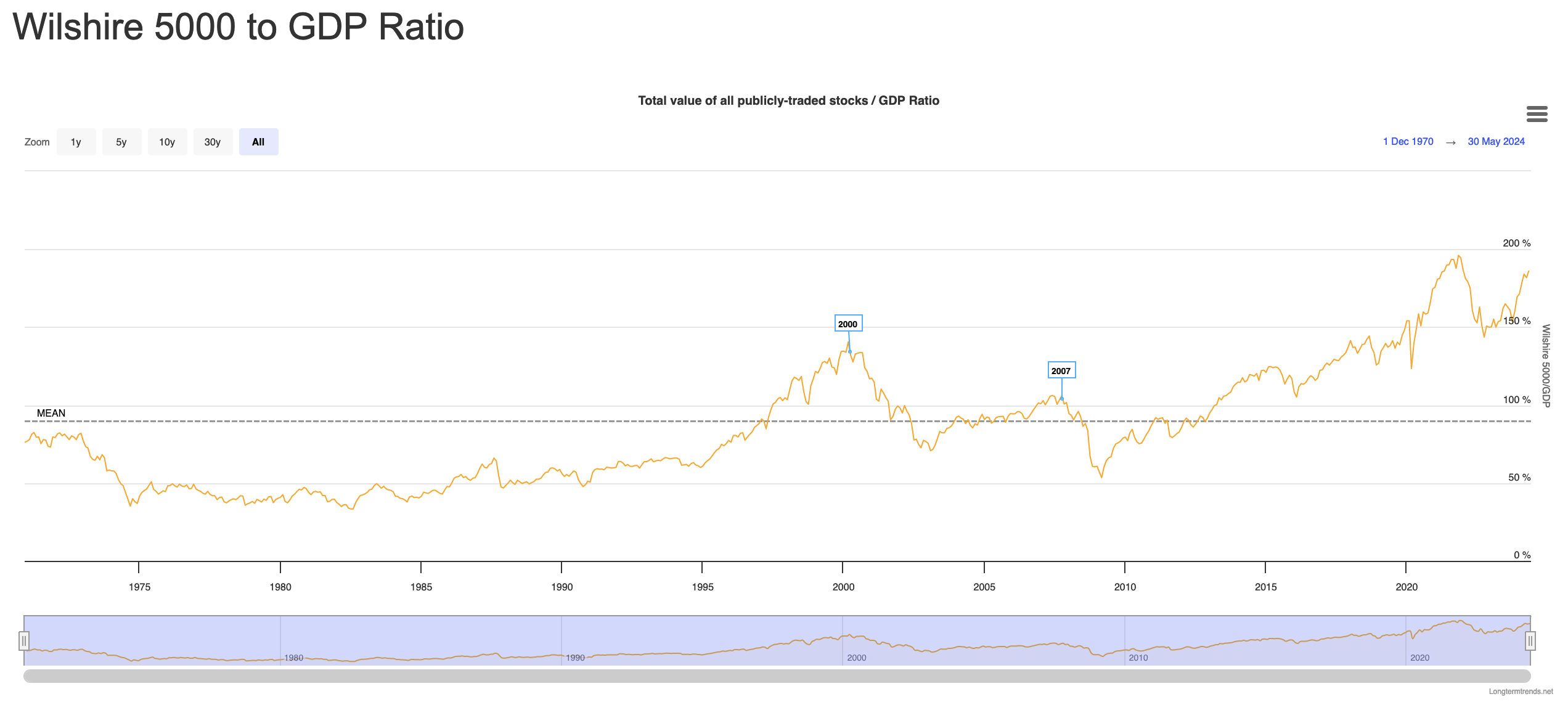

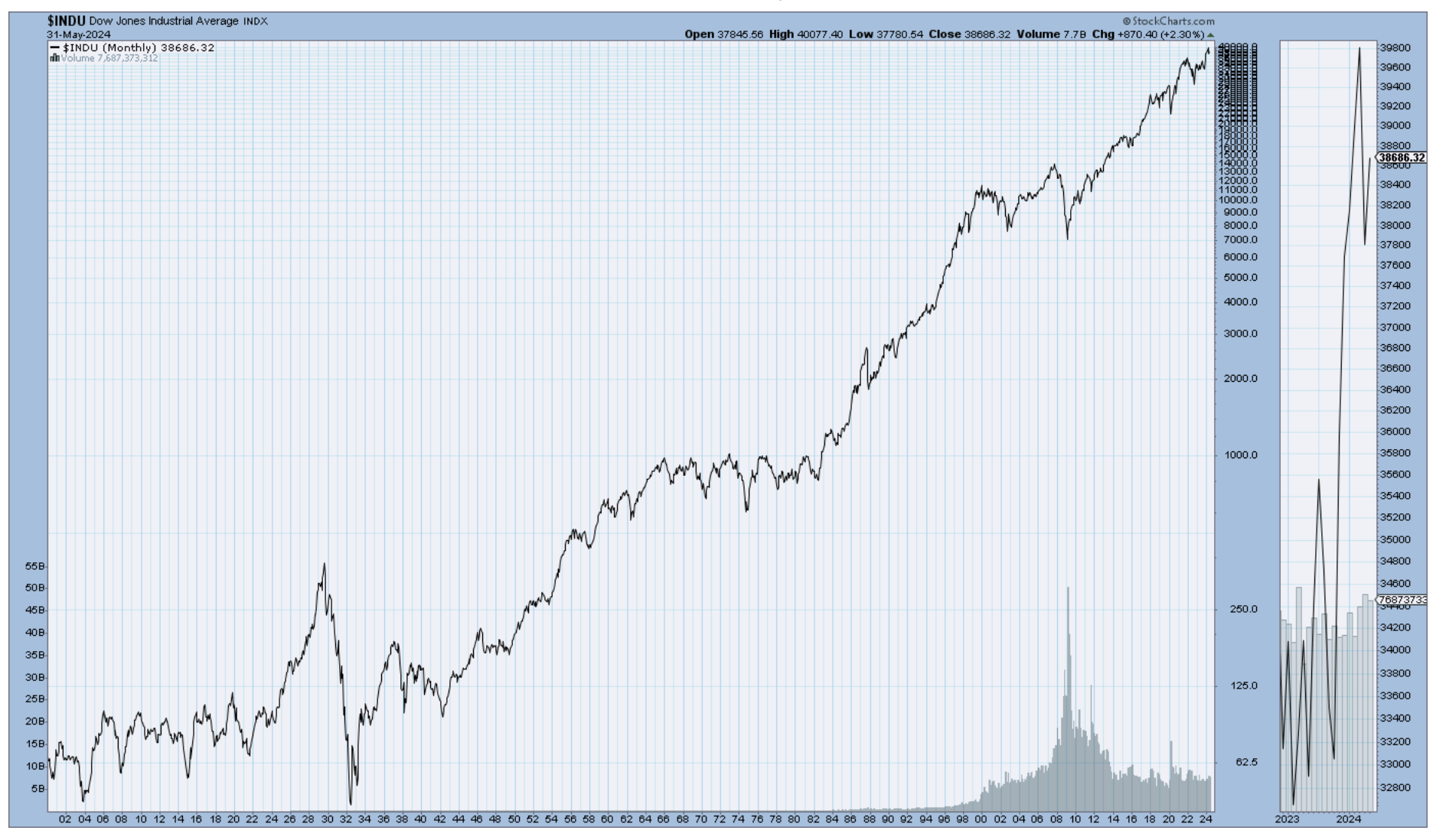

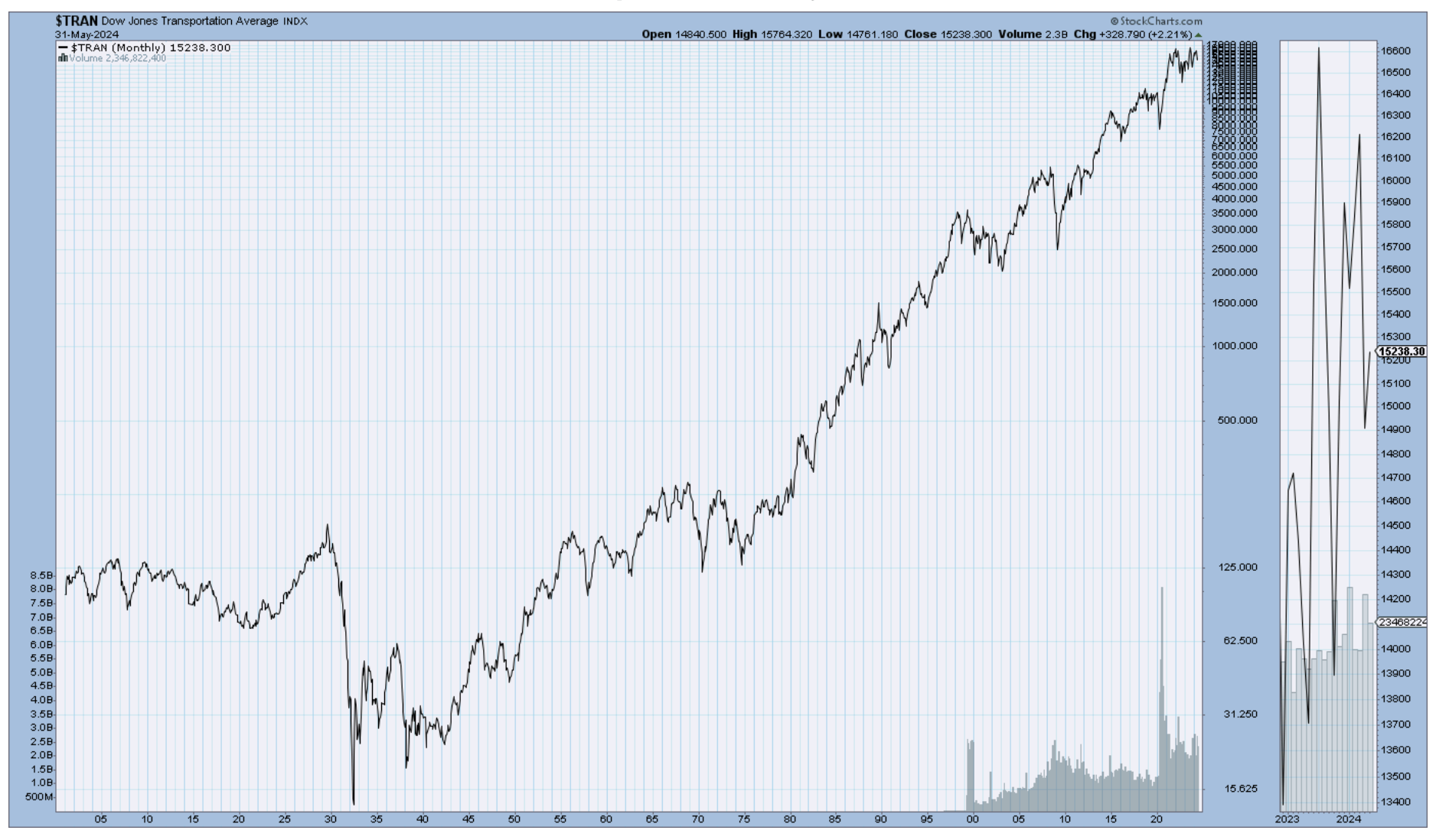

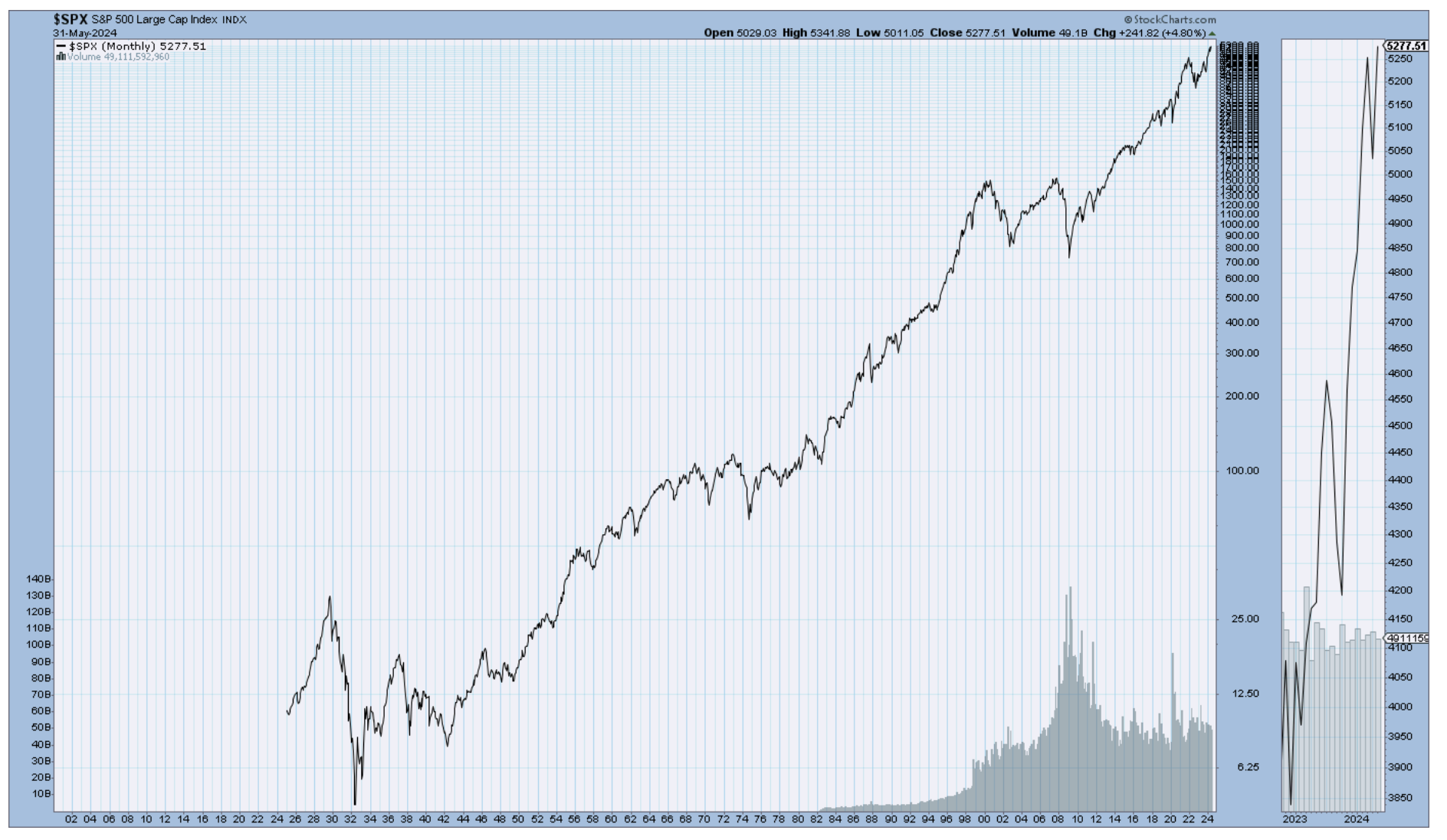

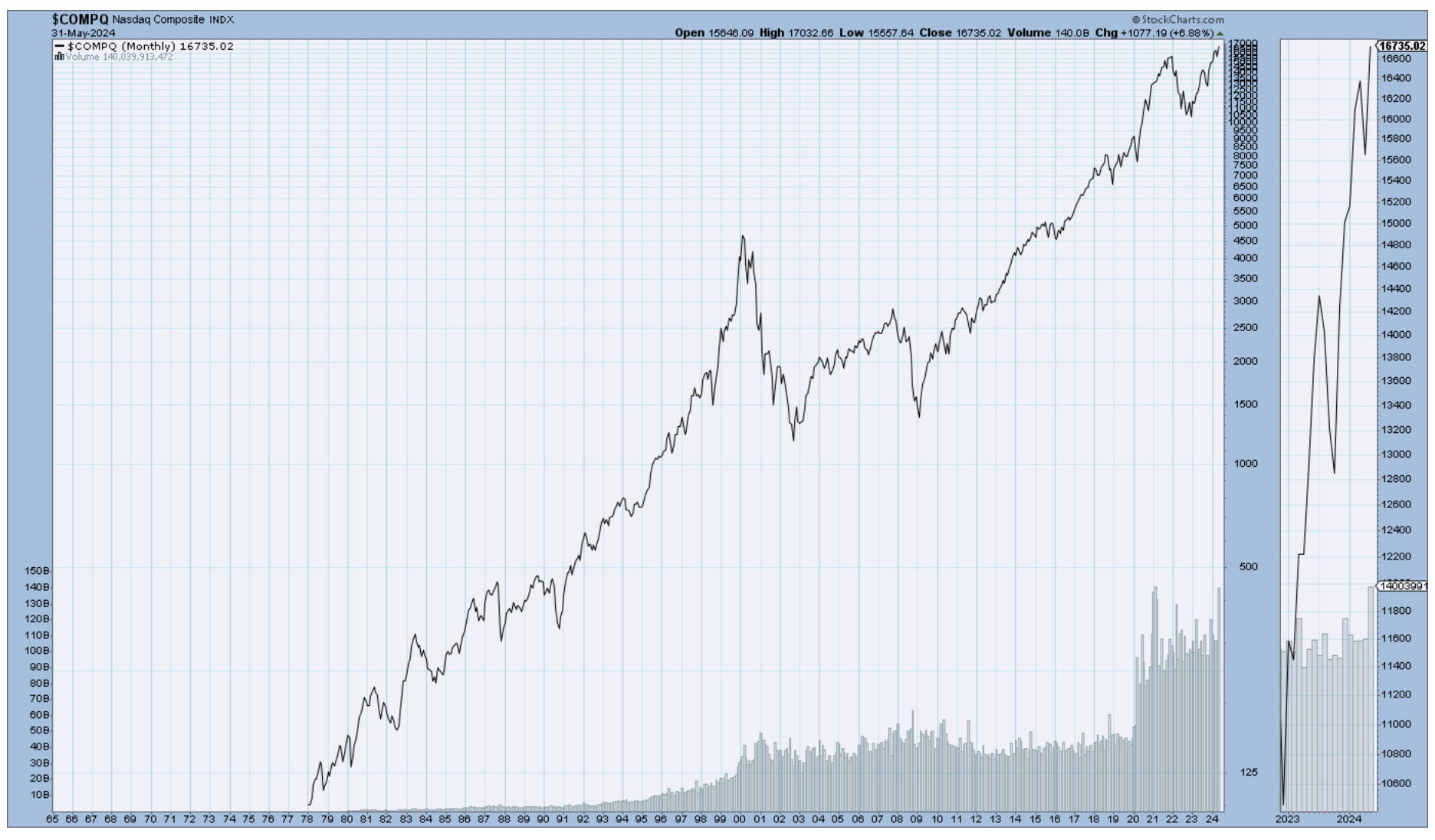

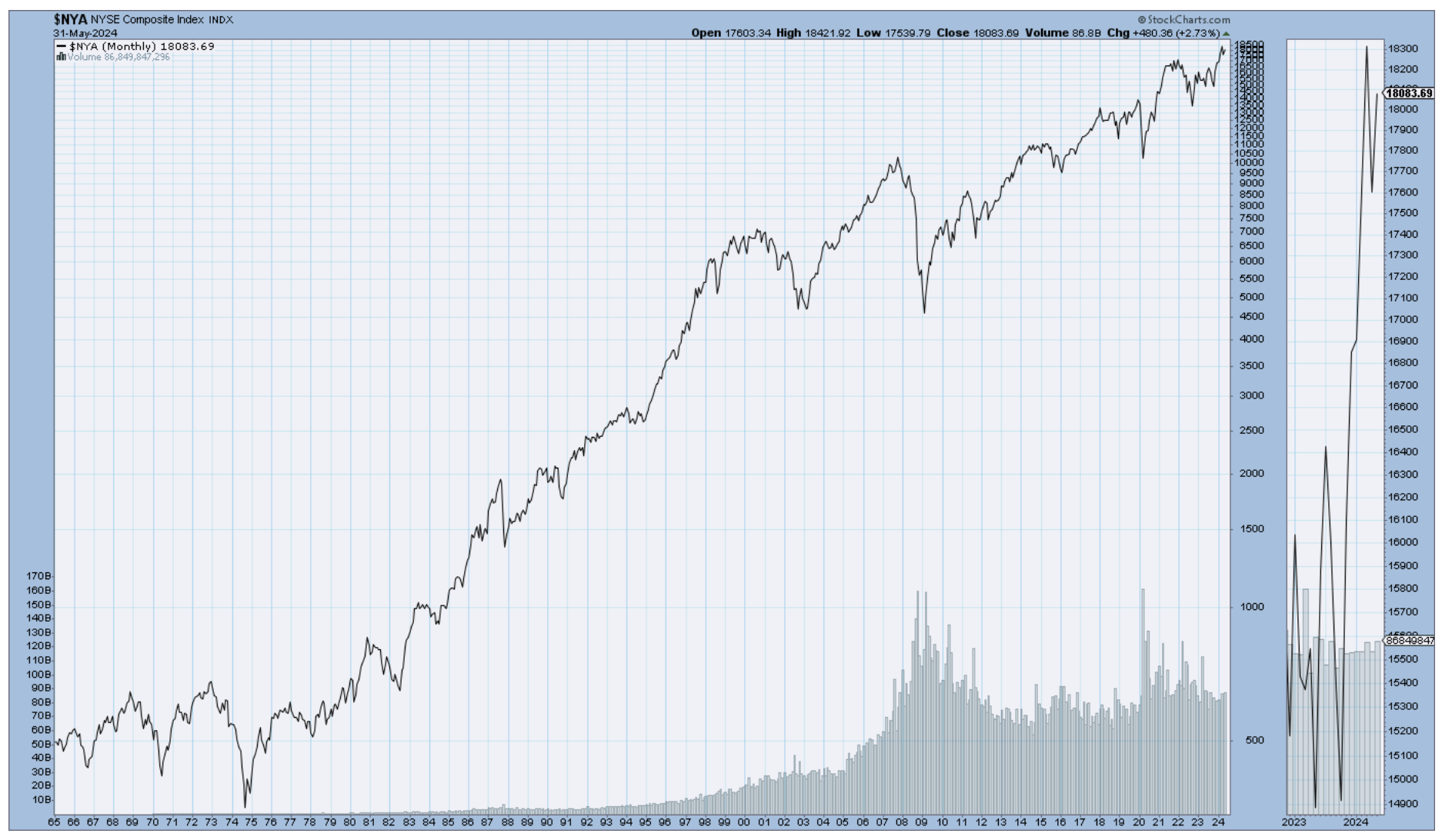

Stocks are at all time highs and so are almost metals as well although they’ve started to come of a little. Evaluations are even higher than in November and there is no sign of a turn in the stock market.

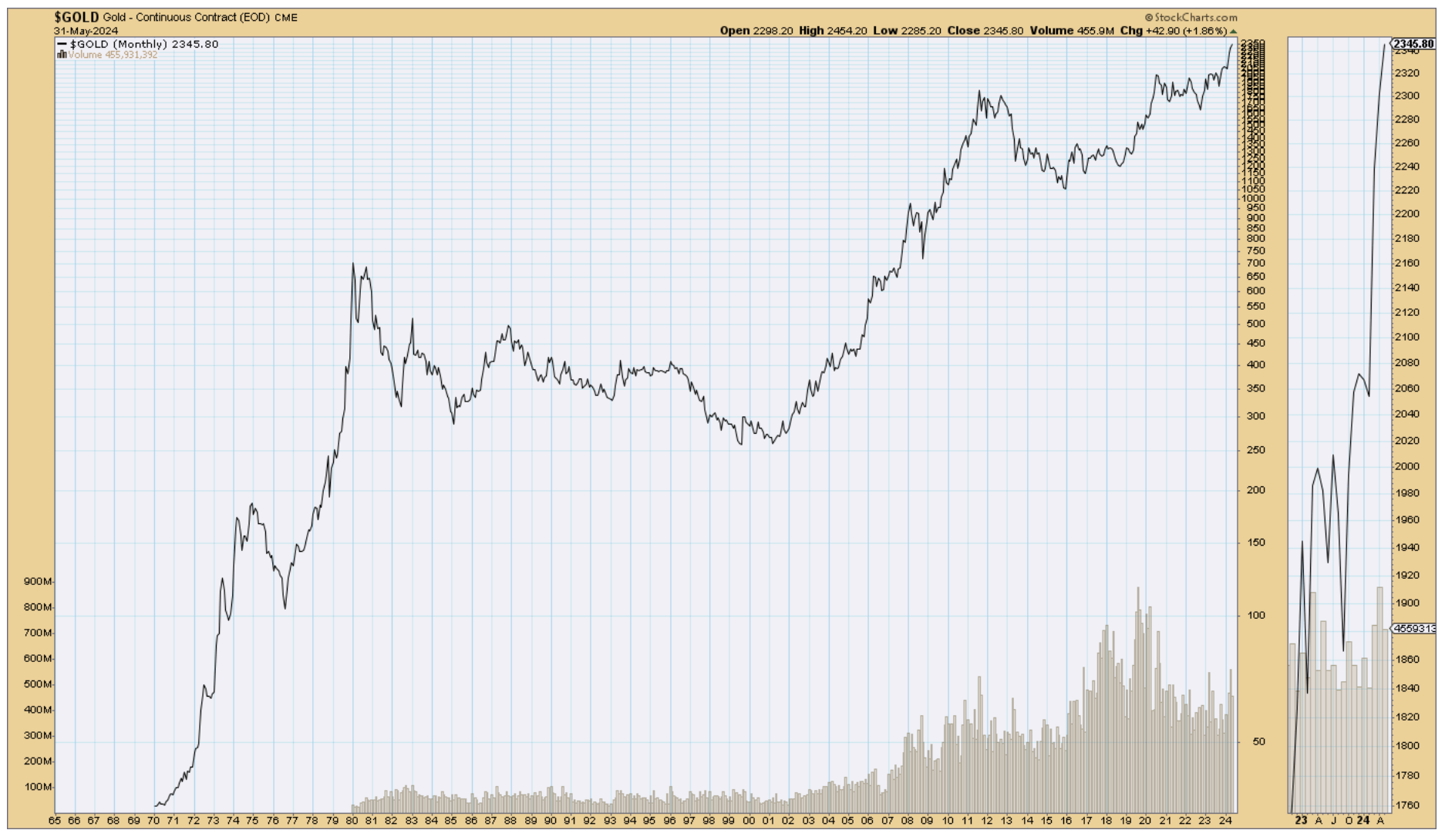

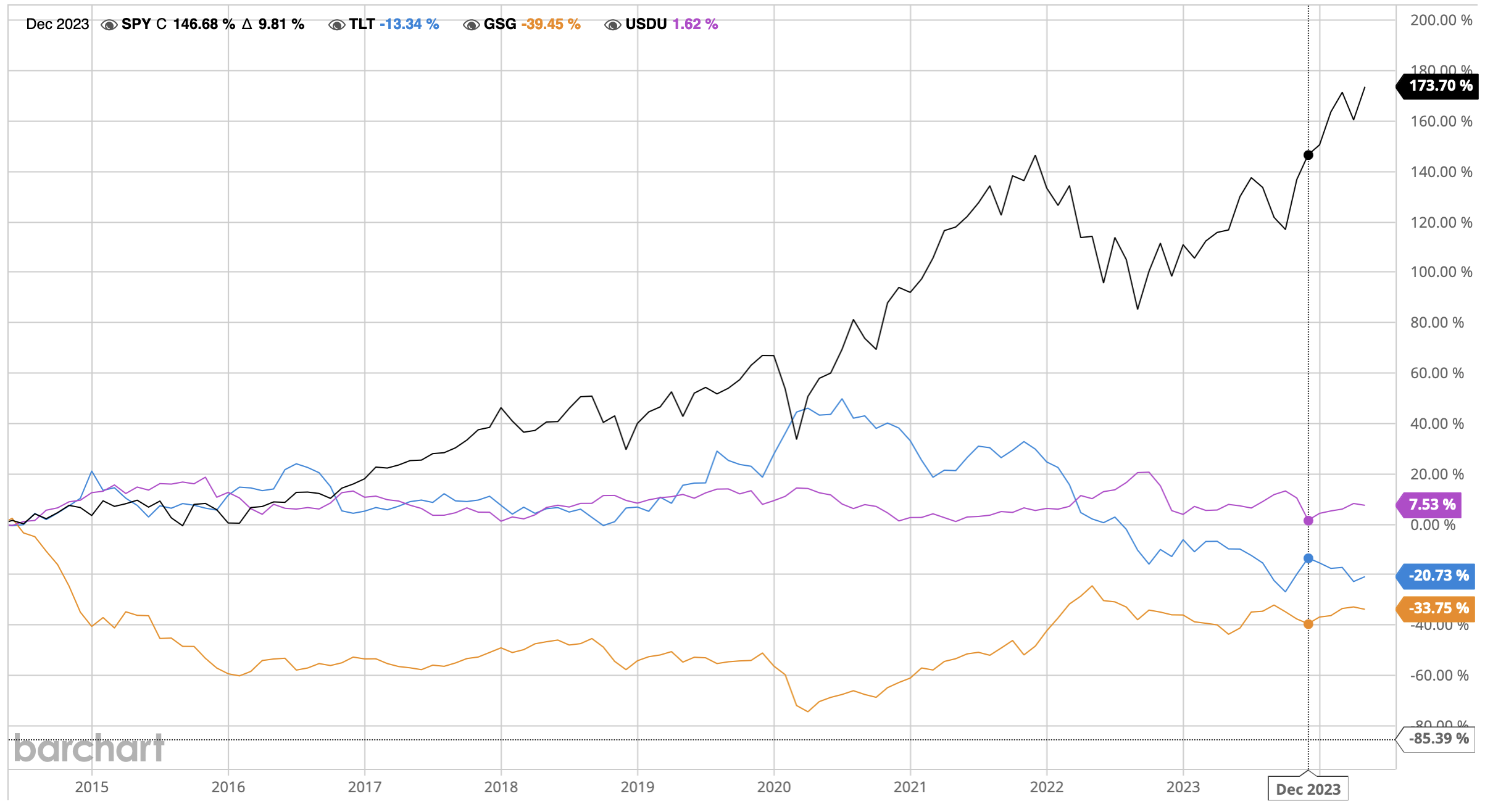

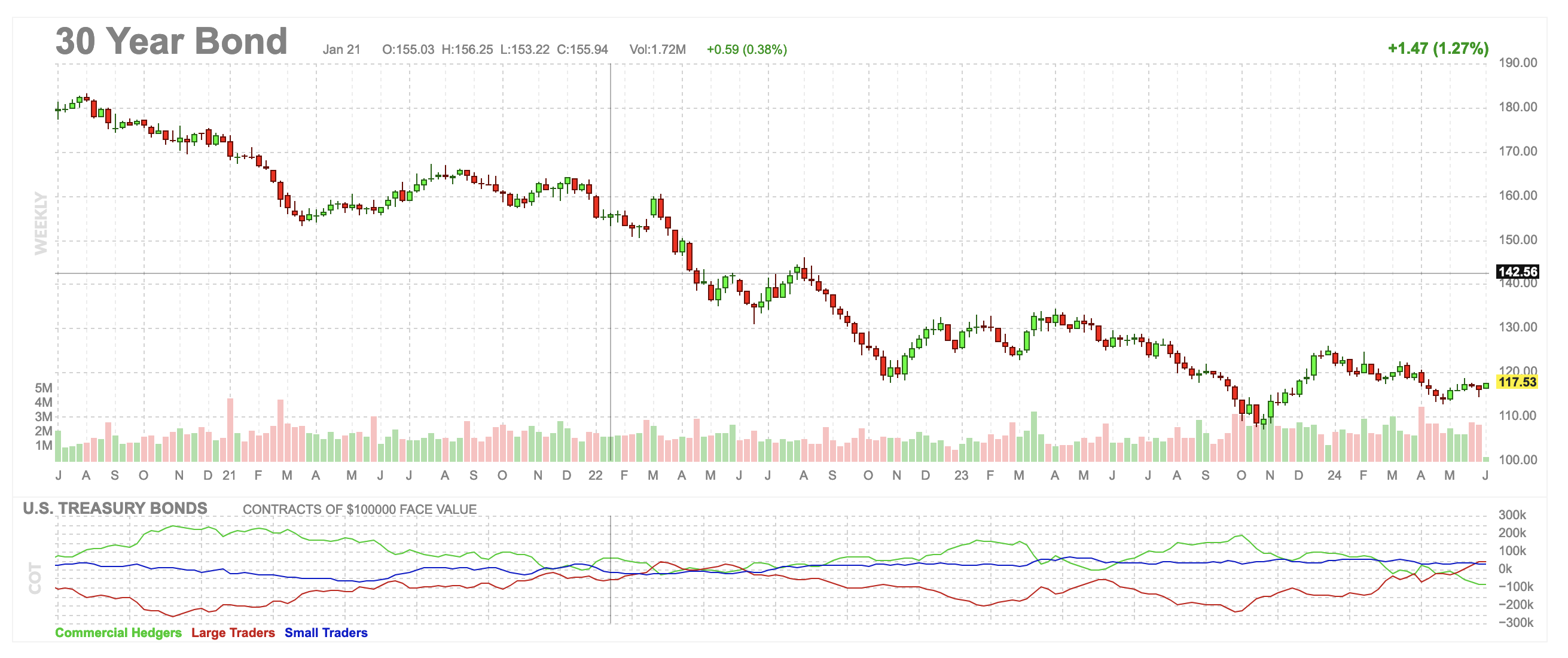

Bonds peaked in mid 2021 and has been declining since then. Stocks did turn down late 2021 but turned upwards mid/late 2022 while bonds continued down during this whole period. Bonds typically move together with stocks and often turn before stocks. Here did bonds not turn up with stocks in late 2020 and stocks have turned first down and then up again and continued upwards. Commodity indexes which often is seen as an indicators of where inflation is heading peaked in early 2020 and seams to be coming down (there are various versions but there taken together there is a downward trend). The US-dollar has been strengthening during 2024 although it’s not as strong as it was 2024. A strong US-dollar typically means falling commodity prices and therefore less pressure on inflation. Commodities, the dollar and stocks move ‘as they should’ but bonds do not. Perhaps it is bonds that will move upwards rather than stocks peaking and moving downwards? 30-year bonds are not the place to go right now from a positioning perspective. 2-year bonds are an alternative, they are quite crowded with traders being short. The short end is affected most the changes in interest rated by the fed, so this would imply a bet on lower interest rates rather than higher. Liquidity most cool down further in assets for this to happen though.

SPY,TLT,GSG and USDU [1]

CRB Index [2]

Not sure this is a good one!? Check this instead: Commodity Indexes

Shiller PE [3]

SP500 Advance-Decline Index [4]

Buffet indicator (Stock market cap/GDP) [5]

2yr [6]

30yr [6]

DJIA [7]

DJTA [7]

SP500 [7]

NASDAQ [7]

NYSE [7]

Gold [7]